/

Buy Dirt

Protect your cash by investing in real estate. In November 2021, the Bureau of Labor Statistics posted an inflation rate of 6.8%. This is the highest recorded inflation rate in 39 years. With borrowing opportunities dipping into the sub 3% range, borrowing makes more sense than ever. It is believed by many that 6.8% is a very conservative number considering the massive expansion of money supply. At the beginning of 2020, the “MO” money supply was approximately $3.5 trillion. The latest measure of the “MO” money supply is at $6.33 trillion, an over 81% increase from 2020.

Additionally, a stock market bubble greater than 2008 is on the horizon as cultic type investment in stocks like Tesla continue. As of the date of this writing, the Tesla stock price to earnings ratio is over 357. At current earnings, it would take 357 years to return the price paid for the stock.

Without spending too much time looking at all the crazy anomalies and bubbles in our economy, the smart thing as Americans, as investors, is to prepare for inflation. This raises the question. How do we prepare for inflation and protect the value of our savings?

Inflation eats away at your net worth by decreasing the purchasing power of your CASH. However, certain assets continue to increase in value with inflation. Some perform better than others. Furthermore, your debt becomes less of a burden in an inflationary period. Buying a real estate asset using debt is a good investment strategy when inflation exceeds borrowing rates. Choosing a scarce, high demand asset further adds to the quality of the investment.

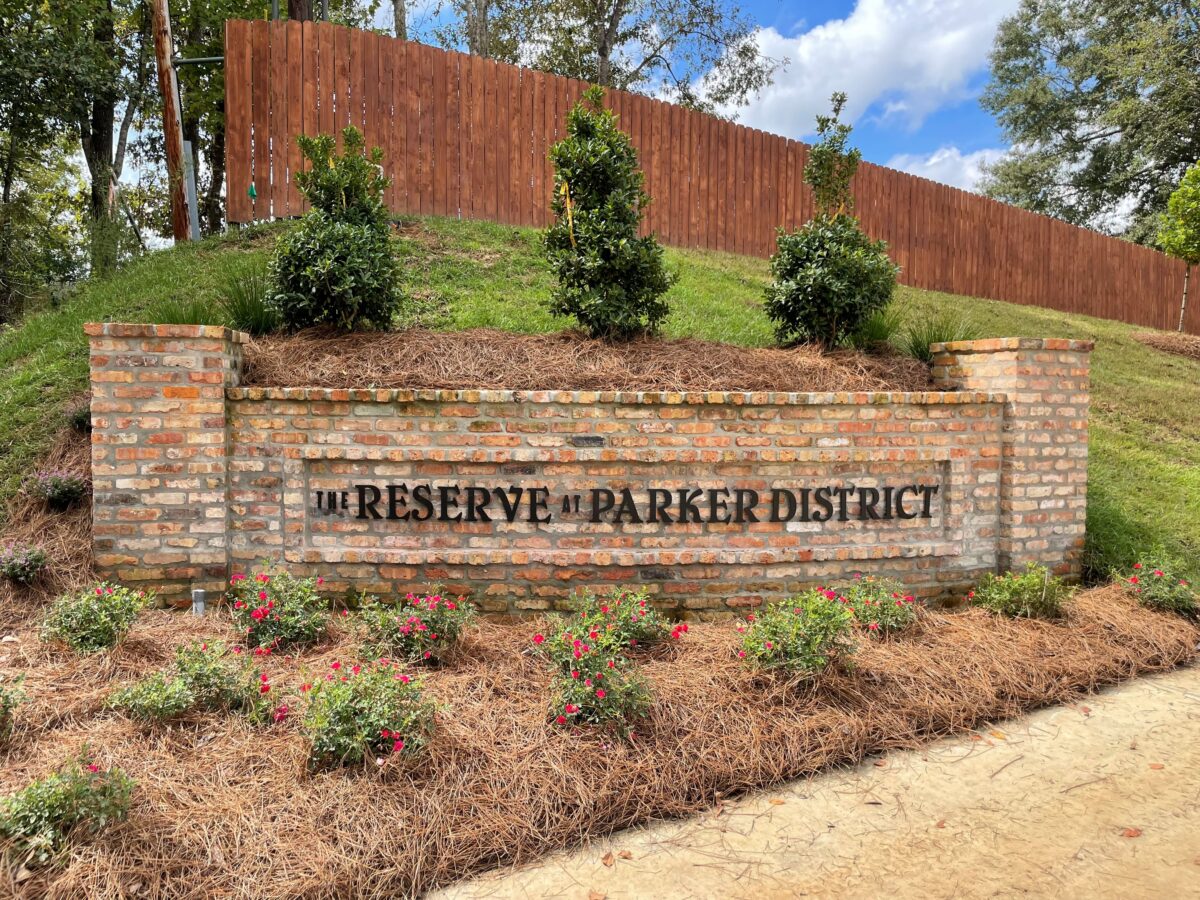

In employing this strategy, purchasing a lot in The Reserve at Parker District may be a good option. Financing is available. If bitcoin is part of your portfolio and you wish to diversify, we will accept bitcoin as a payment option.

DISCLAIMER: ParkerDistrict.com is not a registered investment, legal or tax advisor or a broker\dealer. All investment\financial strategy is our opinion based on personal experience and research and are intended as educational material. We suggest you talk to a knowledgeable investment professional to understand your risk of employing any investment\financial strategy as part of your overall investment plan.